Crypto VC Hits $4.59B in Q3 as Seven Deals Capture Nearly Half

Crypto VC funding hit $4.59 billion in Q3 2025, the highest since late 2022, with nearly 60% flowing into firms like Revolut and Kraken.

Quick Take

Summary is AI generated, newsroom reviewed.

Crypto VC funding reached $4.59 billion in Q3 2025, marking a strong rebound driven by large late-stage deals.

The capital was highly concentrated, with only seven deals capturing almost 50% of the total investment.

Late-stage companies, including Revolut and Kraken, received 60% of all dollars invested in the quarter.

The median crypto deal size reached $4.5 million, with valuations sitting near peak 2021 levels.

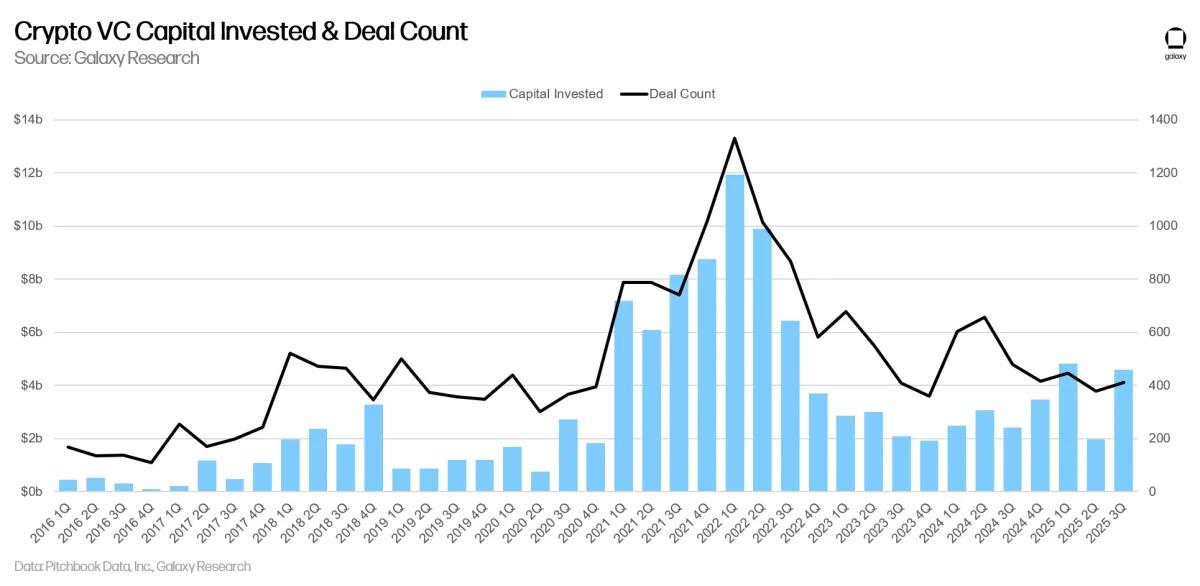

Crypto venture capital bounced back in the third quarter of 2025. According to Galaxy Research, VC investment totaled $4.59 billion. This marks the second-highest quarter since late 2022. While activity remains far below bull-market peaks. The increase shows that investors are still willing to back strong crypto companies when the opportunity looks right.

Chart 1 – Crypto VC Capital Invested & Deal Count by Galaxy Research

However, the capital was highly concentrated. Only seven deals captured nearly half of all Q3 investment. That pattern reflects a cautious environment where investors prefer established names over early experiments. Deal count stayed mostly flat compared with Q2. This signals a more selective but steady market.

Late-Stage Rounds Dominate as Revolut and Kraken Lead

Galaxy Research noted that almost 60% of all Crypto VC dollars flowed into late-stage companies. This is the second-highest share since early 2021. Investors leaned heavily on familiar brands with proven revenue and stable user growth. The biggest deals highlight that trend. Revolut raised $1 billion. While Kraken secured $500 million.

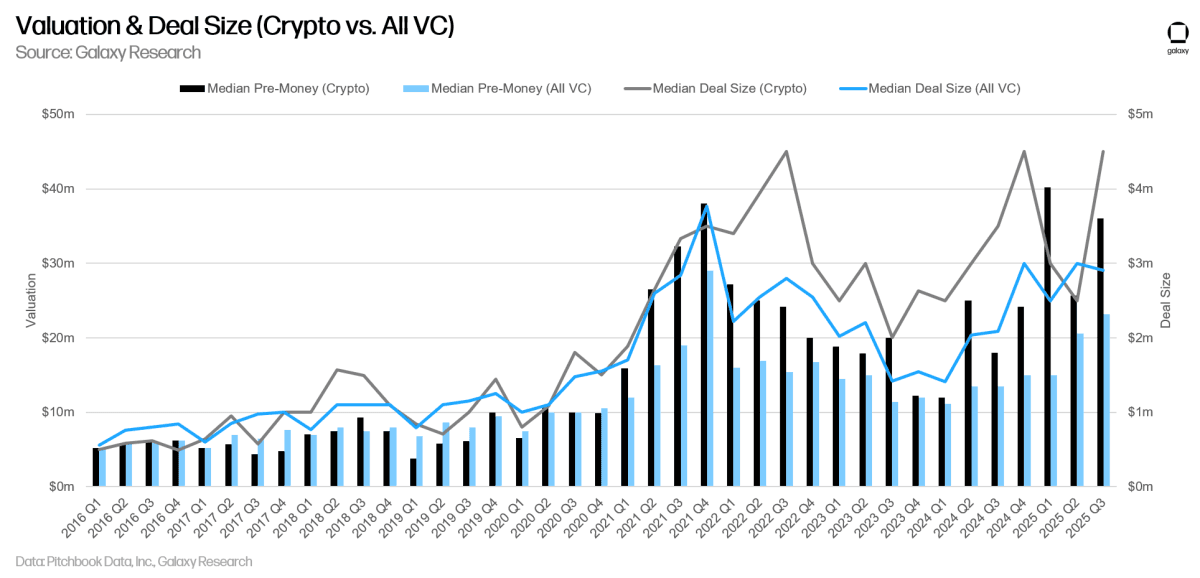

Chart 2 – Valuation & Deal Size (Crypto vs. All VC) by Galaxy Research

Other major raises included Erebor at $250 million, Treasury at $146 million. Additionally, Fnality is at $135 million, Mesh Connect is at $130 million and ZeroHash is at $104 million. These massive rounds pushed median deal size to new highs. The median crypto deal reached $4.5 million. With median pre-money valuations hitting $36 million. Crypto valuations now sit close to peak 2021 levels.

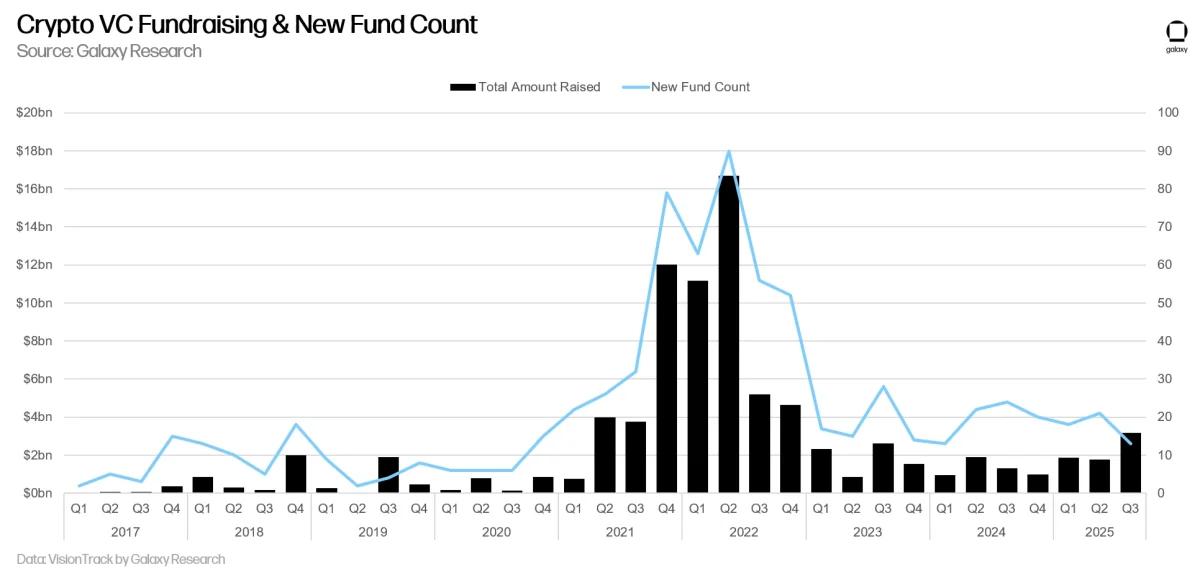

Fundraising Recovers but Allocator Interest Remains Weak

Although startup funding rose, venture fundraising remained challenging. Sixteen new crypto VC funds raised $3.16 billion in Q3. Most of that came from two large exchange-linked vehicles. Traditional allocators and generalist Crypto VC firms have not fully returned since the 2021 cycle.

Chart 3 – Crypto VC Fundraising & New Fund Count by Galaxy Research

Competition is also growing. Allocators now have alternatives like spot crypto ETFs and digital asset treasury companies (DATCOs). These products offer liquid, low-maintenance exposure to the crypto markets. This makes them appealing compared to long-term Crypto VC commitments. Still, 2025 is on pace to be the strongest fundraising year since 2022. Fund managers believe sentiment could improve further. If regulatory changes in the United States continue moving in a pro-crypto direction.

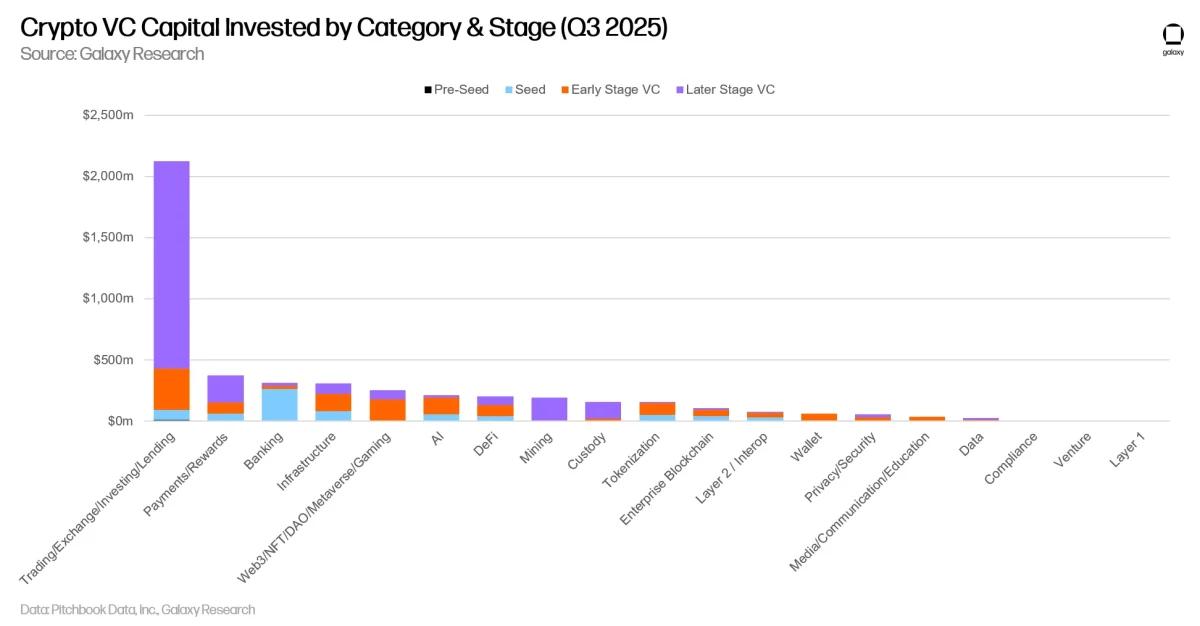

Trading and Infrastructure Lead, While Web3 Diversifies

Trading, exchange, and investing platforms raised the most capital in Q3. These businesses remain the most mature category in crypto. Yet the deal count shows a healthier mix across emerging sectors. Areas like AI, DeFi, tokenization, payments and infrastructure all posted active deal flow. Pre-seed activity remains steady. This suggests that entrepreneurial energy has not faded. But the share of early-stage deals is slowly declining as the industry matures.

Chart 4 – Crypto VC Capital Invested by Category & Stage by Galaxy Research

Geographically, the United States continues to dominate. It captured 47% of Q3 capital and 40% of all deals. The UK ranked second, followed by Singapore and the Netherlands. Overall, Q3 Crypto VC activity shows a market that is cautious but moving forward. Large late-stage rounds are carrying the momentum. While early builders continue to push new ideas into the next cycle.

Follow us on Google News

Get the latest crypto insights and updates.

Related Posts

Bitcoin Breaks Away From MAG7 After October 10 Liquidation Shock

Triparna Baishnab

Author

BNB Hack Abu Dhabi Highlights Web3 Growth as WLFI and USD1 Ecosystem

Triparna Baishnab

Author

Jim Cramer Says He’s Buying Bitcoin Over $37 Trillion U.S. Debt: “For My Kids”

Triparna Baishnab

Author