CryptoQuant Says Bitcoin Likely Range Bound Entering 2026

CryptoQuant predicts BTC will remain range-bound between $80,000 and $140,000 in 2026, as on-chain leverage resets.

Quick Take

Summary is AI generated, newsroom reviewed.

Bitcoin is expected to trade between $80,000 and $140,000.

Neutral on-chain signals suggest a lack of structural trend.

Decreased leverage reduces the risk of massive liquidation cascades.

Long-term holder distribution has paused, easing recent supply pressure.

CryptoQuant says Bitcoin is likely to remain range bound as the market enters 2026. With no clear structural signal pointing to a sustained bullish or bearish trend. The assessment comes from a new research note that evaluates macro conditions, derivatives activity and key on-chain indicators. According to the analysis, Bitcoin is still trading in a high-volatility range. While long-term adoption themes remain intact, short-term price direction lacks confirmation. Analysts described the current setup as conditionally neutral to slightly bearish.

Range-Bound Structure Seen as Base Case

CryptoQuant outlined three possible scenarios for Bitcoin in 2026. Among them a broad trading range is considered the most likely outcome. Under this base case, Bitcoin could trade between $80K and $140K through much of the year. The research identified the $90K to $120K zone as the most active core range.

Analysts said intermittent capital flows, mainly driven by ETFs, are supporting prices. But not enough to fuel a sustained breakout. They added that expectations of rate cuts continue to offer background support. However, weak real economic recovery and cautious investor behavior are limiting upside momentum. As a result, price action remains reactive rather than trend driven.

Downside and Upside Scenarios Remain Conditional

The report also outlined a downside scenario tied to macro stress. If recession risks deepen and risk assets face broader deleveraging, Bitcoin could fall below $80K. In a more severe case, analysts said a move toward the $50K area cannot be ruled out. However, this scenario was given a lower probability. CryptoQuant noted that leverage has already declined sharply since late 2025.

That reduction lowers the risk of cascading liquidations, even during periods of stress. On the upside, a more optimistic scenario depends on multiple conditions aligning. These include early policy easing, stable ETF inflows and improving macro confidence. If those factors materialize together, Bitcoin could push toward $120K to $170K. Still, the report stressed that this remains a low-probability outcome for now.

On-Chain and Derivatives Signals Show Balance

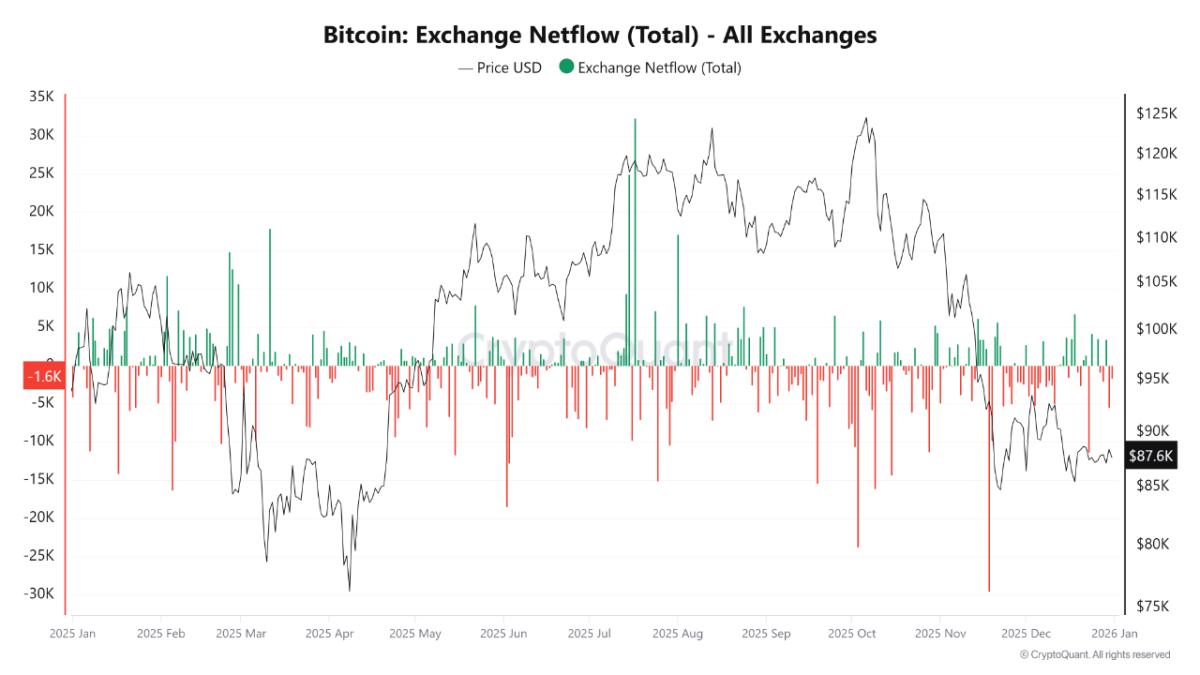

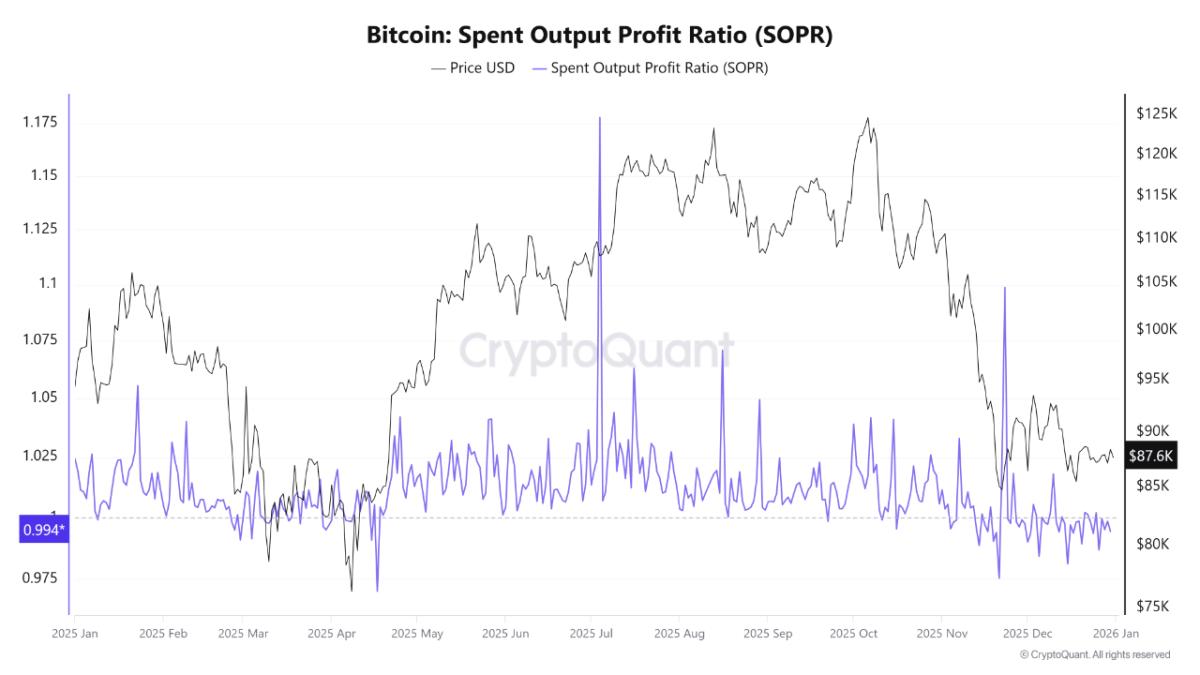

Several on-chain indicators support the range-bound view. Exchange reserves and net flows show no strong accumulation or distribution trend. At the same time, futures open interest has normalized after peaking in mid-2025.

Chart 1- Bitcoin Exchange Netflow (Total) – All Exchanges from CryptoQuant

Chart 2- Bitcoin: Spent Output Profit Ratio (SOPR) from CryptoQuant

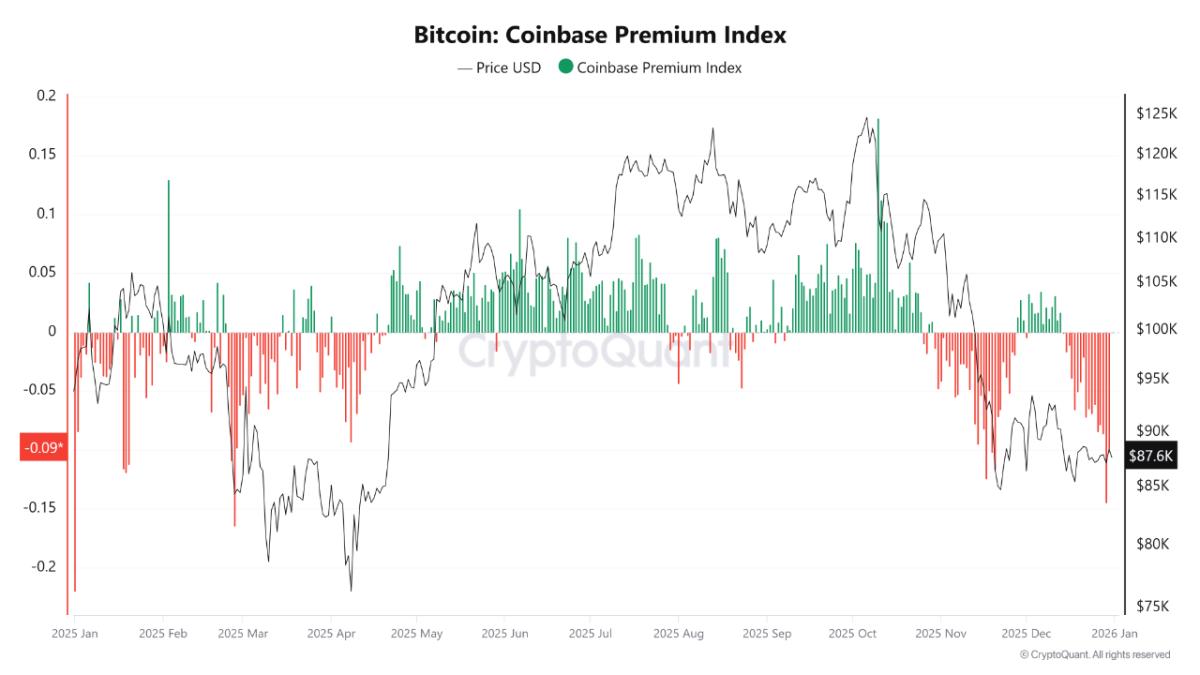

The systemic leverage ratio, which tracks derivatives exposure relative to market size. It has fallen back to more sustainable levels. Analysts said this reset reduces fragility but also dampens explosive upside moves. CryptoQuant emphasized that no single metric will define the trend. Instead, the interaction between ETF flows, futures positioning and long-term holder behavior will determine which scenario unfolds.

Market Awaits Clear Confirmation

Currently, CryptoQuant maintains that Bitcoin lacks the structural confirmation needed for a decisive trend. Analysts said the 2026 outlook remains flexible and subject to reassessment as data evolves.

Chart 3 – Bitcoin: Coinbase Premium Index from CryptoQuant

Until stronger signals emerge, they expect traders and investors to operate within defined ranges rather than chase directional bets.

Follow us on Google News

Get the latest crypto insights and updates.