Uniswap Launches Seven AI Agent Skills for Onchain Trading

Uniswap Labs launches seven new AI skills on its Beta Developer Platform, enabling automated swaps and liquidity planning.

Quick Take

Summary is AI generated, newsroom reviewed.

Uniswap launches seven open-source Skills for autonomous AI agent integration.

New tools enable agents to execute swaps and deploy v4 hooks.

Developers can install the toolkit via the npx skills add command.

Release targets standardized, agent-native DeFi workflows on the Ethereum network.

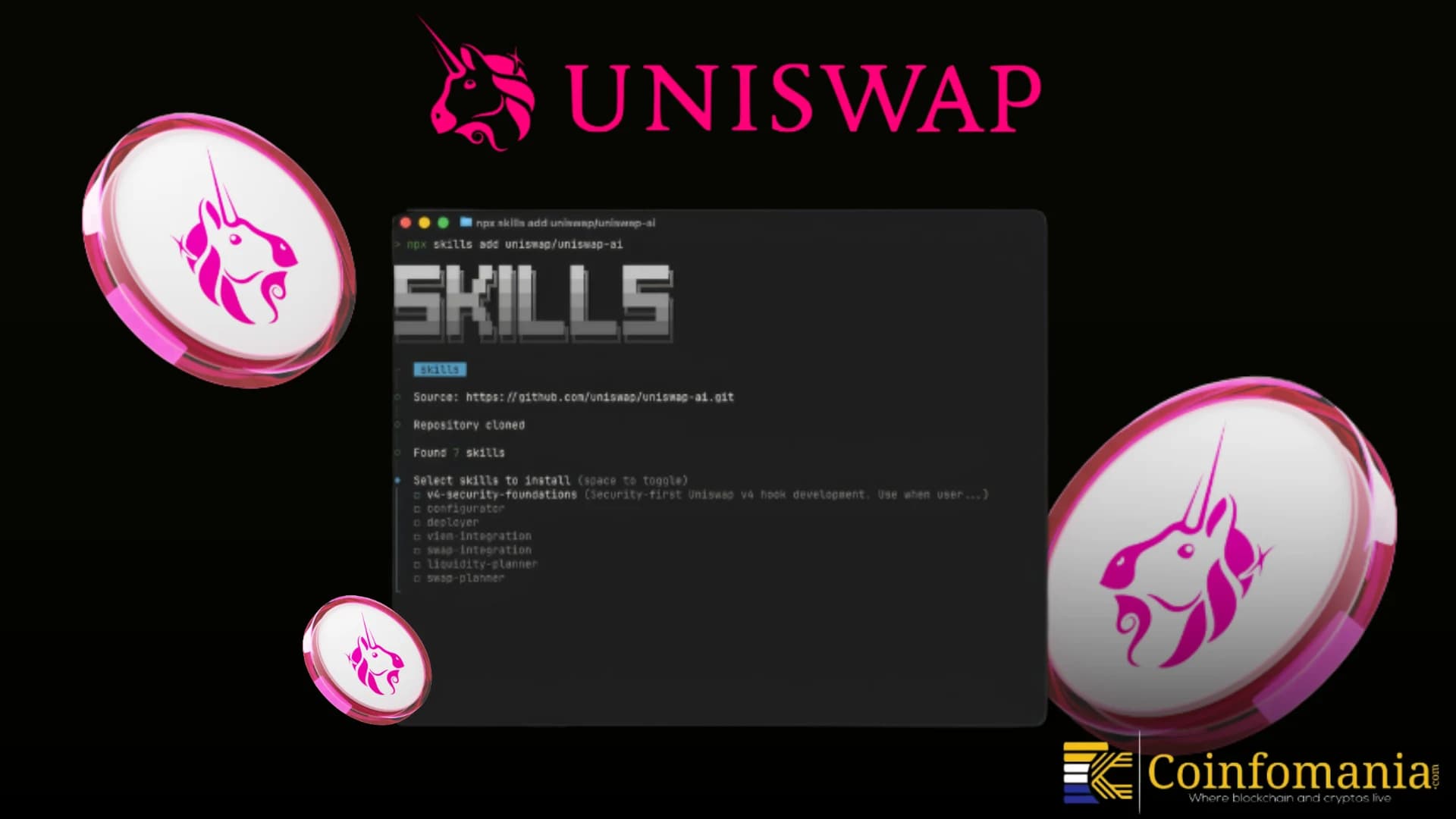

Uniswap Labs rolled out seven new open-source “Skills.” It is designed to let AI agents operate directly on the Uniswap protocol. The tools give structured access to core actions like token swaps and liquidity moves. Developers can install them quickly using a simple command such as: npx skills add uniswap/uniswap-ai. The update marks a clear push toward agent driven DeFi workflows. Early reaction on X looked upbeat. With builders calling it a meaningful step toward autonomous onchain trading systems.

What the New AI Skills Actually Do

The new release focuses on making AI interactions with Uniswap more reliable and standardized. Instead of loose prompts, agents now get structured interfaces to execute key tasks safely. The seven core Skills include security foundations, configurator tools, deployer support, viem integration, swap integration, liquidity planning and swap planning.

Uniswap Labs announced the release of 7 new "Skills" to enable AI Agents to execute operations on Uniswap. The 7 core skills specifically include: v4-security-foundations, configurator, deployer, viem-integration, swap-integration, liquidity-planner, and swap-planner.…

— Wu Blockchain (@WuBlockchain) February 21, 2026

In simple terms, these tools help agents quote trades, execute swaps, manage liquidity positions and prepare Uniswap v4 hook deployments. They also add guardrails meant to reduce common execution mistakes. This matters because earlier AI trading experiments often failed due to messy integrations or missing checks.

Uniswap designed the Skills to work across different coding agents and environments. They are not locked to one AI model. That flexibility could help speed up adoption across the growing agent ecosystem.

How Developers and Agents Get Started

Uniswap is clearly aiming for low friction here. Developers can install the full toolkit with a single command-line step. The Skills are already live on GitHub under the uniswap-ai repository. Along with documentation and examples.

Because the package is open source, teams can modify or extend it for their own workflows. The setup also supports common developer tools and agent frameworks. That means builders don’t need to reinvent the plumbing every time they want an AI to interact with Uniswap. This plug-and-play approach lowers the barrier for smaller teams experimenting with agentic finance.

Why This Matters for DeFi and AI

The bigger story is the rise of agent-native DeFi. For months, developers have talked about AI systems that can rebalance portfolios, chase yield or execute complex trades automatically. Until now, the tooling remained fragmented and fragile.

Uniswap’s move helps standardize how agents touch onchain liquidity. That could unlock faster development of automated traders, intent solvers and smart liquidity managers. It also fits into Ethereum’s broader push toward AI-friendly infrastructure.

Still, risks remain. Autonomous agents can misfire if logic breaks or market conditions shift fast. Security, monitoring and human oversight will still matter. Some developers already warned that production use needs careful testing despite the cleaner interfaces.

Early Reaction and What Comes Next

Initial community feedback has been largely positive. Builders on X called the release a strong foundation for agent workflows and asked for similar Skill packs from other DeFi protocols. Uniswap Labs has invited developers to submit feedback and contributions through GitHub. If adoption picks up, 2026 could see a shift from manual DeFi activity toward AI-assisted execution. For now, Uniswap has fired an early shot in what looks like the next big infrastructure race onchain.

Follow us on Google News

Get the latest crypto insights and updates.